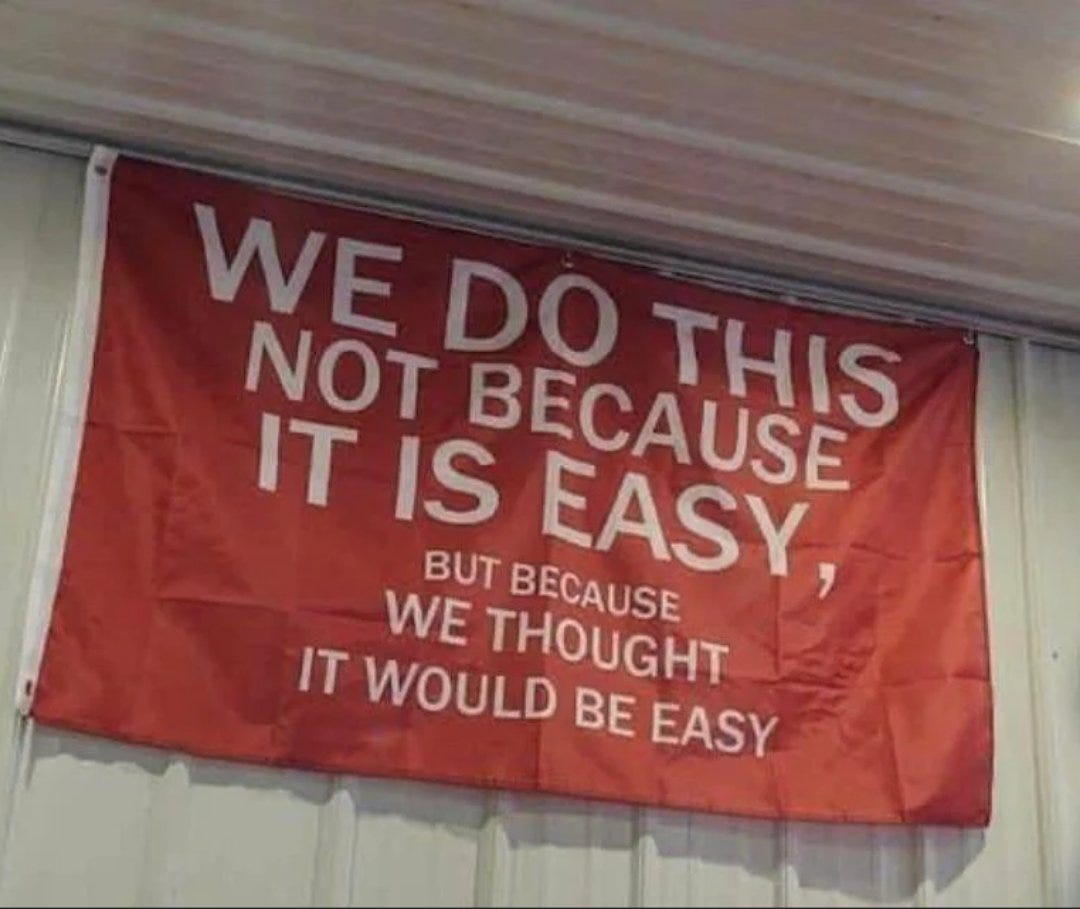

2023 Fintech Outlook: "We Thought it would be Easy"

#BaaS #Lending #Chime #DailyPay #DataStack #EmbeddedFinance

Macro outlook: the worst is not over yet

In a separate future post, I’ll dive into why I see more pain ahead in the broader economy and market.

My predictions below stem from the above assumption about the macroeconomy.

1. The Year of Reckoning

Some fintechs were dead in 2021, and 2023 is when they find out they are dead.

The following areas in fintech may feel the pain acutely next year, in my view:

Nonsensical business models will receive little mercy and thus little funding in a flight-to-quality environment, unlike the the easy ride they enjoyed in the frothy market in 2021. No more founder cashing out before realizing PMF (let’s hope at least 🙏🏼).

Inherently unprofitable fintechs will face a “pivot or die” moment. For example, interchange revenue alone is not a sustainable business model, with very few exceptions.

The shakeout in BaaS will deepen, driven by continued regulatory scrutiny, and the knock-on impact of struggling fintechs, which tend to dominate certain BaaS platforms’ customer list. More fundamentally, the shakeout in BaaS will also deepen as the industry matures: some BaaS customers will outgrow the boxed-in capabilities offered by certain platforms, and will instead seek more customized and scalable solutions; further, the fallout of the BlockFi credit card program exposed the downside of partnering with BaaS platforms.

Many fintechs will learn an expen$ive lesson that lending profitably is hard (emphasis on profitably). See precedents at Carvana, Goldman, Upstart, among many others. Some fintechs may have enough runway and internal talent to turn their lending businesses around, but some will run out of time while trying.

To be clear, I don’t think fintech will die in 2023. Yet 2023 will be a year where people again say “fintech is hard”.

2. Continued Consolidation

As I predicted in my 2022 outlook, the consolidation has arrived in fintech and will continue through 2023. If the unfriendly fundraising condition lasts and if the IPO market remains muted, more reluctant targets may finally turn into willing sellers.

Yet not every company shares my assessment-case in point, DailyPay, which recently rebuffed a solid takeover offer from Chime, still favors an IPO strategy. Per my estimate, Chime’s $2bn offer represented >10x of LTM revenue multiple. Granted 65% of the offer was in Chime stock; yet after adjusting for a 2022-level equity valuation, the offer still hovers around 7-9x LTM revenue, per my estimate. This print is in line with the multiple achieved in the Coupa take-private deal, although DailyPay likely enjoys a higher growth rate than Coupa.

The Chime-DailyPay case shows precisely the buyer-seller disconnect that still persists in the current market. Something’s gotta give in 2023.

3. Spotlight on the Data Economy

In 2023, everywhere you look, you need data.

Focus on the bottom line? You need data to track P&L. More regulatory reporting? You need data to answer regulators’ questions. Generative AI? You need data, lots of data.

Yet data, especially financial data, remains stubbornly scattered, messy, cryptic. Open banking tools such as Plaid and Nova Credit are only the first building blocks in unlocking the true value of financial data. I’m excited to explore and fund new solutions to access, cleanse, organize, and extract value off of financial data.

4. More Contextual Lending

I’ve been bullish on contextual lending and I look forward to more of it in 2023. In my 2022 outlook, I explained my enthusiasm for contextual lending:

For the next phase in the financialization of all companies, I’m not talking about a repeat of Lending Club; instead, innovation will come from contextual lending, whereas lenders command richer data and can capture high-intent borrowers with the right product at the right time.

To support contextual lending, the industry demands a modern core to provide lending-as-a-service... Building on top of LaaS platforms-coupled with a robust go-to-market strategy-these contextual lenders will scale rapidly.

Some early movers in contextual lending have arrived…but this is still largely a greenfield.

There will be billion dollar companies among the new batch of LaaS providers and contextual lenders

What are you looking forward to in 2023?